Renting out a Room? The shared economy and how this may affect you

Renting out a Room? The shared economy and how this may affect you

The shared economy has quickly become a very prominent feature in today’s world. It enables people to enjoy the benefits of ‘things’ without the hassle and costs involved with owning them.

On the other hand, if you are providing the items in the shared economy then these services can generate a great additional income stream in times when you are not using the asset yourself.

Popular examples of sharing economy services include:

- Airbnb and Stayz: Renting a room, whole house or unit on a short time basis.

- Uber: Providing ride sharing services for a fee.

Although these services may be a welcome complimentary income source, there are potential tax implications by way of income tax, goods and services tax (GST) or other taxes that apply to the earnings.

Things to consider when renting a room, unit or whole house:

- You will need to keep records of all income earned:

- All income includes;

- Rental income before fees and commissions,

- Insurance payouts, e.g., compensation for damage caused by renting,

- Bonds or security deposits you become entitled to retain,

- Letting and booking fees, including cancellation fees.

- All income includes;

- You will need to keep records of expenses you can claim as deductions:

- Deductions you may be able to claim include;

- Fees from the facilitator (i.e.. The booking website)

- Power and gas,

- Property insurance and council rates (CGT consequences may apply)

- Cleaning and maintenance

- Other associated expenses (i.e. food for BnB options etc.)

- Deductions you may be able to claim include;

- You will need to determine if all or part of the expense can be claimed.

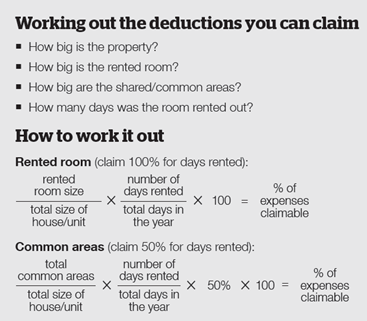

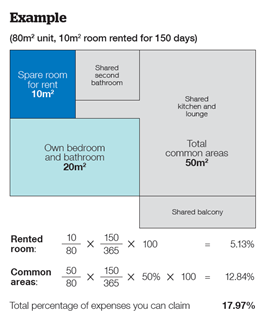

- This will depend on:

- The number of days you rent out the property during the year,

- The portion of the property you have rented out (i.e. a room or the whole property),

- How you use the property, including any personal use.

- This will depend on:

How to work out the proportion of the deductions you can claim:

Capital Gains Tax:

- When you sell the property that is being used for sharing activities you may have to pay capital gains tax on the portion that has been used. This will have to be determined at the time of selling. This highlights the importance of record keeping for all shared activities.

Note: you do not need to pay GST on amounts of residential rent you earn. However, if you are carrying on an enterprise renting out commercial residential premises you have different income tax and GST obligations.

The ATO have incredible data matching powers that pick up the movement of funds from sharing activities and cross check this against the income declared in your tax return. The ATO also has the power to review and amend previous tax returns with no date limit if they believe a fraudulent omission of income has occurred.

If you are considering using your home or property for sharing activities and require further information or if you have any specific questions regarding the above or any other tax matter, we are here to help you! Please feel free to contact us either by phone or email.