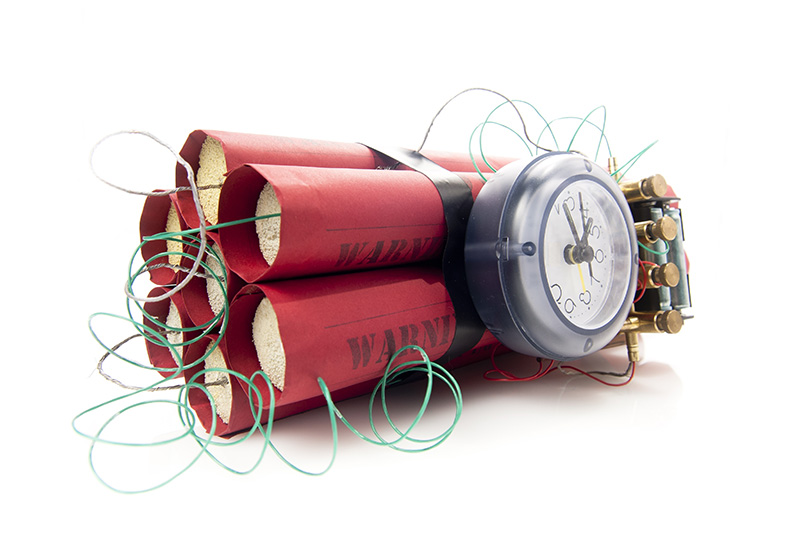

Airbnb Hosts Are Ignoring This Capital Gains Tax Timebomb

Airbnb Hosts Are Ignoring This Capital Gains Tax Timebomb

This abridged article by Debra Cleveland below recently appeared in the Australian Financial Review and we wanted to share it with you.

Airbnb hosts are on notice from the Australian Tax Office to declare rental income in their tax return. But what many of them don’t realise is that the taxman can still take a chunk of their sale price when they sell their properties.

Tax experts warn that many people who rent out a room in their home have no idea they’re sitting on a capital gains tax (CGT) time bomb.

Most assume CGT is not even on the cards because usually any profit on the family home (or “primary residence”) is tax-free. But because they are earning an income from a portion of the family home, some of the endgame capital gain could be up for grabs by the taxman.

This is the case, of course, whether it is let via Airbnb or another avenue.

“CGT is one of those things that often gets calculated many years down the track but is affected by events throughout the vendor’s ownership period,” says accountant Wei Shiek, founder of online accounting outfit Sansdesk. “They may not remember or be able to locate records about a relatively short period in which they were renting part of the house out on Airbnb.”

So how much tax could hosts be looking at? Well, it depends on how much of your property is rented out and for how long.

Speak with us if you have any questions or concerns about your particular circumstances.